Redefining Saudi: A new economic era

HLB FDI Insights

Saudi Arabia is strategically positioned to expand its economy and shift away from its traditional reliance on oil exploration. Amidst an environment of controlled inflation, the country is embracing structural reforms and public investment programs, setting a course for sustainable growth and enhanced global engagement.

Central to this transformative journey is the Vision 2030 Programme, an ambitious initiative launched by the government to reshape key facets of the country's economy and society. This program stands on three main pillars:

-

-

An Ambitious Nation

-

Enhancing Government Effectiveness

-

Enabling Social Responsibility

-

-

A Thriving Economy

-

Growing and Diversifying the Economy

-

Increasing Employment

-

-

A Vibrant Society

-

Strengthening Islamic and National Identity

-

Offering a Fulfilling and Healthy Life

-

-

In alignment with Vision 2030, Saudi Arabia has initiated a comprehensive public spending program on major projects. This initiative aims not only to stimulate economic growth and reduce oil dependency but also to create substantial private-sector employment opportunities.

These initiatives are backed by the Program Investment Fund (PIF), a sovereign wealth fund. The PIF is tasked with developing a diverse portfolio of projects designed for economic returns and strategic alignment with Vision 2030's goals. Moreover, the fund's investments extend beyond local projects, with significant contributions to assets outside Saudi Arabia, reflecting the country's evolving global investment strategy.

Spotlight on Saudi Arabia

Improving the business environment in Saudi Arabia is a government concern. Plans to transform the country’s economy also include attracting foreign direct investment. Current legislation dealing with foreign investments (Foreign Investment Law) has removed many obstacles and facilitated the approval of new businesses and the inflow of capital from abroad. Another initiative is the launch of the Special Economic Zone (SEZ), which aims to attract investment in sectors such as renewable energy, mining, cloud computing, logistics and the digital economy, also the creation of the Investment Law Business Regulations Zone (ILBZ), in Riyadh, which offers a series of benefits and tax exemptions for companies that set up shop there.

Although the Saudi government is sending clear signals that it intends to attract foreign capital, investors need to keep in mind that there are weaknesses to be considered:

- High dependence on hydrocarbons sector;

- The economy is dependent on public spending;

- Weak political governance;

- Weak economic transparency.

Key trends

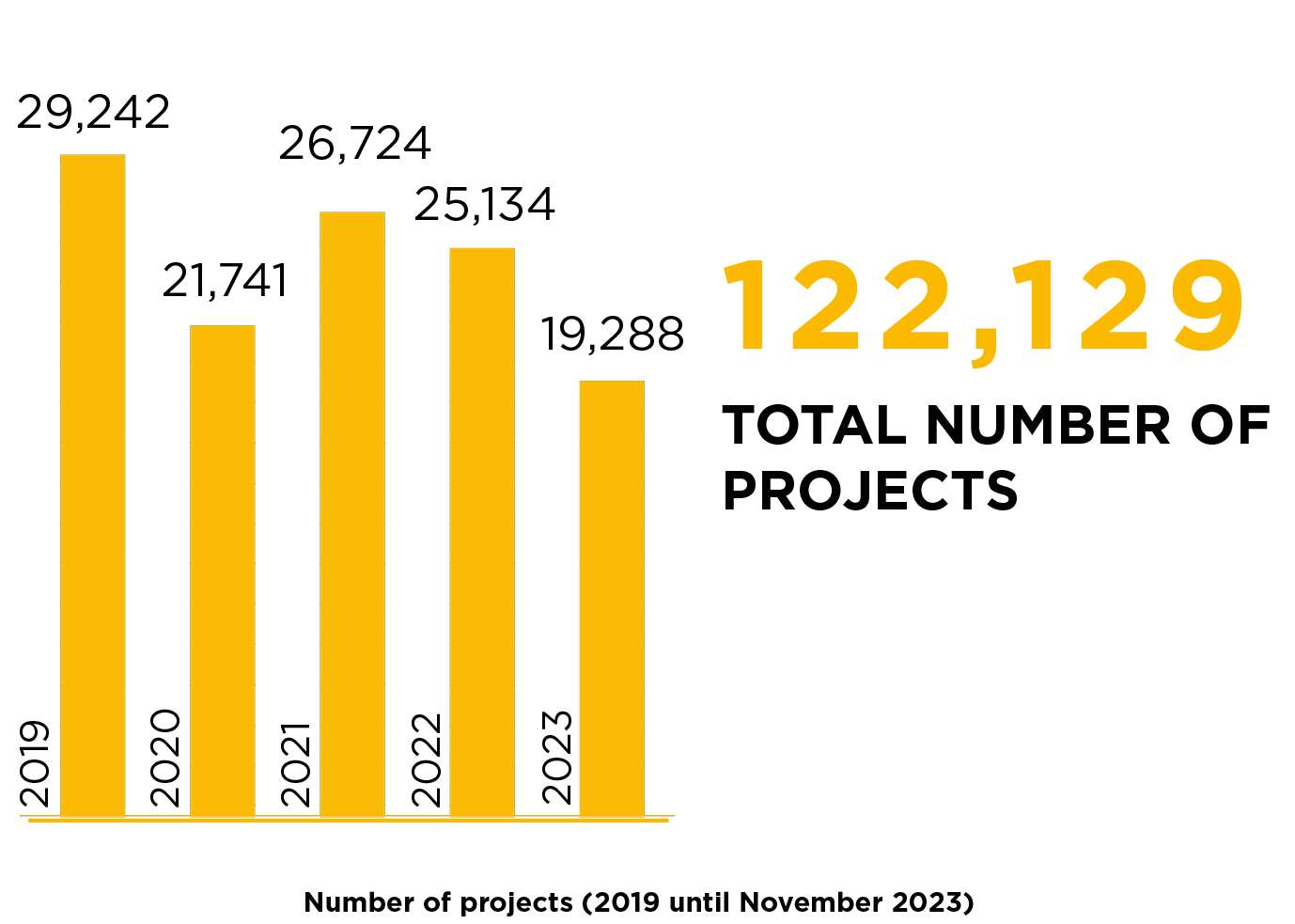

For the purpose of this report, only announced and already executed projects were considered (also were not considered reinvestment of profits earned in operations abroad and intercompany loans):

- Total capital expenditure in projects in 2023 is higher than 2022, although the number of projects is lower.

- Retail is the sector with the highest number of projects.

- Highlights include:

- Sales office;

- Manufacturing;

- Business services.

Source of data: Orbis Crossborder Investment

Recent project highlights

- Compagnie de Saint-Gobain (France) to acquire Izomaks Industries. Deal value not available.

- GFH Financial Group (Bharain) acquires majority stake in Abha International Private Hospital. Deal value: US$1.3 billion (unofficial).

- Magnum Mining and Exploration and Middle East for Metallic Industrial (Australia) to establish joint zero carbon green pig iron production plant. Deal value not available.